Lyft Now Guarantees Drivers 70% of the Fare

Lyft is ensuring that its drivers, who have complained about pay transparency, will earn at least 70% of rider fares each week and will know exactly the breakdown of where the rider’s fare goes.

GetUpside Review: Will You Save on Gas?

Picture this: you’re driving down the road looking for somewhere to fill up on gas, but everywhere you look, it seems like the prices are too high. That’s where GetUpside comes in to save the day and save you some money.

Top 10 Reasons Windshield Wiper Blades Fail

Windshield wipers are one of the most important safety devices on any vehicle. Without proper visiblity, you cannot see the road ahead and your chances of getting into an accident increase dramatically. If you have noticed that your windshield wipers are streaking, skipping, not cleaning the glass, or just not working in a satisfactory manner overall, one of these reasons could be to blame.

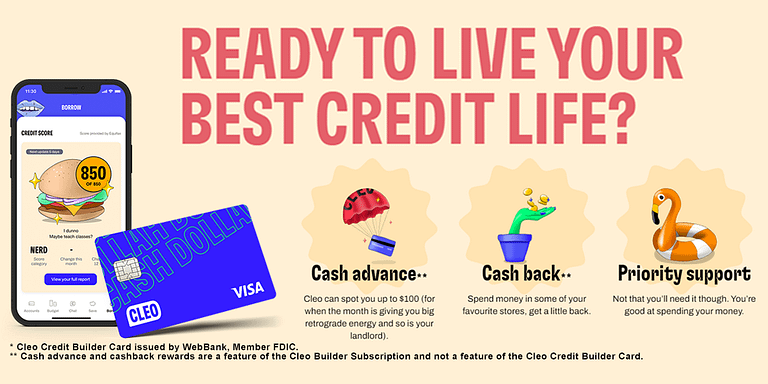

Cleo Card: The Credit Builder That Keeps On Giving

The Cleo card is the credit builder that keeps on giving. It was created by the makers of the budgeting app of the same name. The card was designed with you in mind to help ease the burden of bad credit. Get this! Unlike with other lenders, there is no credit check.

Empower Yourself with the Best Personal Finance Apps of 2021

We’ve put together a list of the top money-saving apps that will help you track your spending, invest your money, and find great deals and discounts.

Uber Driver Pay Rates by City (per Mile and per Minute)

Rideshare drivers keep asking, “how much does uber pay in my city?”, “how much does uber pay per mile?”, “how much does uber pay per minute?”, etc.

A recent Reddit thread asked drivers how much Uber pays in their city, and we have collected the results including the per-mile rate and the per-minute rate.

14 Best Jobs You Can Get without a Degree

What jobs that pay well can I get without a degree? You might be surprised. There are plenty of jobs that you can get without a degree. In addition, there are lots of certifications that you can get in just a few months that will make it easier to qualify for these jobs.

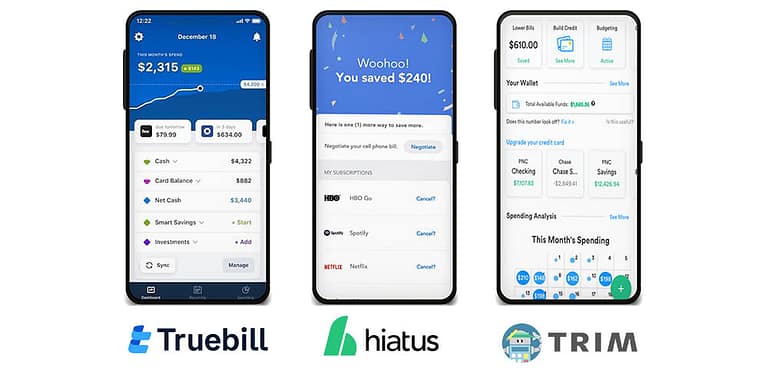

REVIEW: These 3 Apps Lower Your Bills and Save You Money

In this side-by-side comparison review I’m giving the inside scoop on how these three AI-powered mobile cost-cutting apps can not only help you save up to half on your monthly bills but get your finances back on track. Oh, and they even offer subscription cancellation services as well as regular account scans for additional savings on all of your accounts for a small premium.

8 Great Reasons To Drive with HopSkipDrive

HopSkipDrive may not be perfect for every driver, but for the right person, it’s a great opportunity. Great pay, fantastic support, fun customers, and lots of flexibility. It’s great for parents or people that want something extra before and/or after their day job, as well as full-time drivers that want some predictability. If that’s you, it’s worth checking out.

Upwork: Getting Started & Building a Winning Profile

Platforms like Upwork are moving into the spotlight as both experienced gig workers and newcomers seek ways to use their skills and make money on their own terms while avoiding the vehicle wear and tear that comes with passenger and delivery apps.

Acorns: How it Works and Why You Need It

Acorns is the top micro-investing app in the United States. Its easy-to-use, mobile-centered interface makes it easy for anyone to save and invest their spare change. Acorns enables customers to automatically invest in low-cost, diversified portfolios

Judge Rules California Prop 22 Gig Workers Law Is Unconstitutional

On Friday, a California judge ruled that Proposition 22, a ballot measure approved in November that allowed rideshare companies like Uber and Lyft to treat gig workers as independent contractors, rather than employees, was unconstitutional.

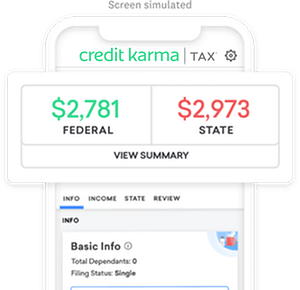

How to Update Your Information for Advance Child Tax Credit Payments

The American Rescue Plan Act expands the child tax credit for tax year 2021. The maximum credit amount has increased to $3,000 per qualifying child between ages 6 and 17 and $3,600 per qualifying child under age 6.

If you’re eligible, you could receive part of the credit through advance payments of up to